Buffett’s Advice for a Volatile Global Market

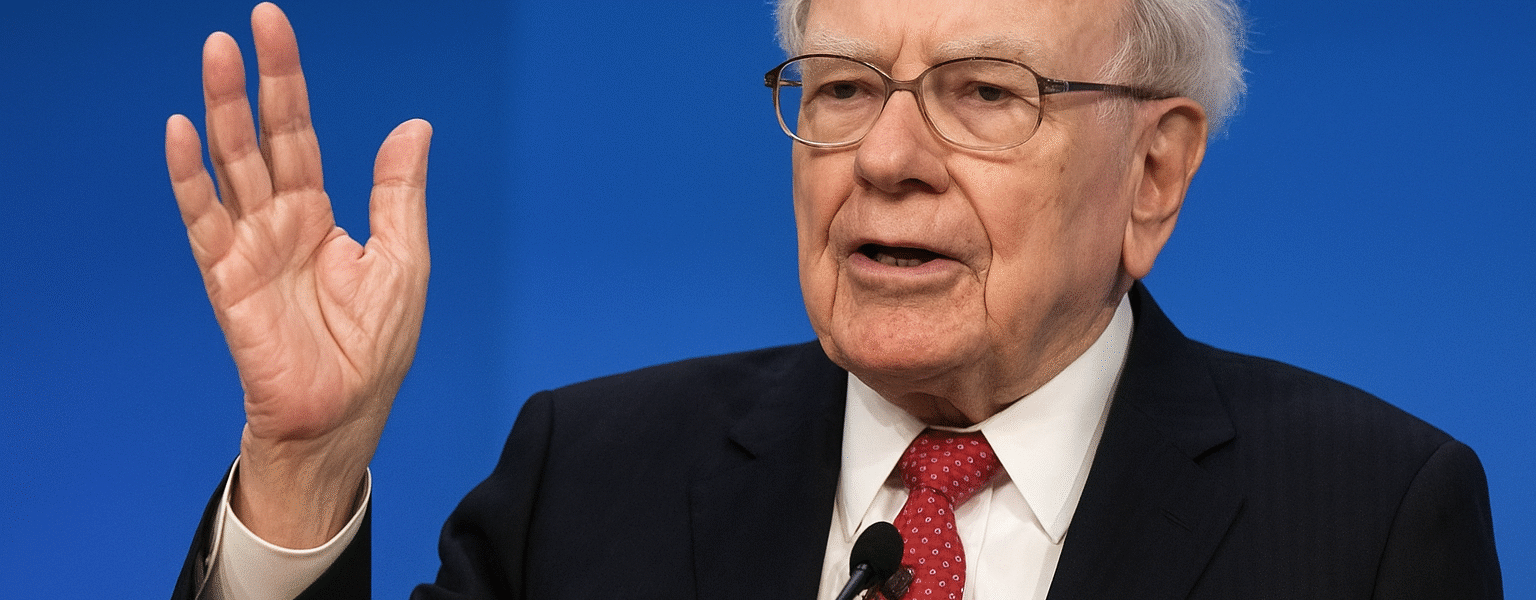

Berkshire Hathaway CEO Warren Buffett has urged investors to remain patient and disciplined amid growing volatility in global markets.

Speaking at the company’s annual shareholders meeting in Omaha, Buffett said rising interest rates and global conflicts are creating “short-term noise” that can mislead new investors.

“The stock market is a device for transferring money from the impatient to the patient,” Buffett reminded attendees.

Caution Against Overhyped Sectors

Buffett warned against chasing “hot trends” such as speculative cryptocurrencies or overvalued startups, saying true investing is about owning real businesses — not just betting on prices.

He compared the current investment landscape to previous bubbles, cautioning that “when the tide goes out, you see who’s been swimming naked.”

Despite the risks, Buffett said opportunities remain strong in energy, consumer goods, and infrastructure, especially in emerging markets with stable growth.

Focus on Value and Real Assets

Buffett reaffirmed his belief in value investing, saying it continues to outperform short-term speculation.

He advised young investors to prioritize cash-generating businesses and companies with strong management rather than following market fads.

“Find businesses you understand and leaders you trust — then hold them for a lifetime,” he said.

Preparing for the Next Economic Cycle

Economists attending the meeting noted that Buffett’s outlook aligns with a global shift toward long-term stability and real assets, as central banks tighten policies and investors look for safer havens.

Buffett also expressed confidence in America’s economic resilience, calling the U.S. market “an engine that’s never stopped running — even after rough patches.”

A Timeless Message for Entrepreneurs

Buffett’s message resonates beyond Wall Street: for entrepreneurs and business leaders, patience and principle remain the foundation of success.

“Success in investing and in life comes down to character, not IQ,” he concluded.