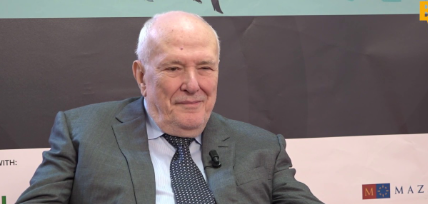

Radhakishan Damani, a low-profile trader, investor, and entrepreneur, often referred to as “Mr. White and White,” stands as one of the top investors in the Indian market. The man behind the highly successful retail chain DMart, Damani’s journey is a testament to his exceptional skills and vision.

Early Life and Background

Born in 1954 in a middle-class family in Bikaner, Rajasthan, Damani’s father, Shivkishanji Damani, was a stockbroker. Despite his humble beginnings, Radhakishan chose to leave his BCom studies midway to pursue business. Initially venturing into the ball bearing business in Mumbai, he shifted gears to join his brother in stockbroking after his father’s death, despite having no prior experience in the field.

The Investing Journey

Damani’s entry into the stock market in his 20s was marked by observation and learning rather than immediate trading. His first investment at the age of 32 led him to register with SEBI. By studying market strategies and observing prominent market operators like Manu Manek, Damani honed his skills in trading and investing. In the 1990s, he capitalized on the market manipulation by Harshad Mehta through short selling, demonstrating his keen market acumen.

Inspired by value investor Chandra Kant Sampat, Damani adopted a long-term investment approach, focusing on fundamentally strong stocks. He made notable investments in companies like HDFC, VST Industries, Blue Dart, Sundaram Finance, Gillette, India Cement, and GATI, which yielded significant profits over time.

Founding DMart

Damani’s interest in consumer business led him to purchase the franchise of the cooperative retail chain Apna Bazaar before founding DMart in 2002. Utilizing the low real estate prices at the time, he strategically acquired properties for DMart, ensuring cost savings on rentals and relocations. His unique approach of owning stores instead of leasing them set DMart apart from its competitors.

By focusing on profitability over rapid expansion, Damani built DMart into a retail giant with over 200 stores across India by 2011. His philosophy of careful calculation before opening new stores ensured that none of DMart’s stores ever had to close.

Mentorship and Legacy

Radhakishan Damani, known for his simplicity and introverted nature, became a mentor to many, including billionaire investor Rakesh Jhunjhunwala. While Damani himself rarely seeks the limelight, his influence in the investment community is profound.

Philanthropy

A significant philanthropist, Damani donated substantial amounts to the PM-CARES Fund and various state relief funds during the coronavirus pandemic. Through the Shivkishan Mindaram Damani Charitable Trust, he also provided affordable lodging for families of patients in South Mumbai, quietly contributing to society without seeking recognition.

Success Principles

Damani’s success is attributed to his consistent and persistent efforts, keen observation, and learning from failures. His strategy of investing in quality stocks at low valuations and holding them long-term has proven highly effective. As a businessman, he values customers, vendors, and suppliers, ensuring DMart stores offer low-cost products and prompt payments to suppliers.

Conclusion

Radhakishan Damani’s life story as a successful broker, investor, and entrepreneur continues to inspire the young generation. His humility, farsightedness, and business acumen are often studied by investment institutes and firms, making him a legendary figure in the Indian market.